The U.S. housing market is short by 3.8 million homes, and there’s no way of softening it. According to an analysis published by mortgage-finance company Freddy Mac, by the end of 2020, the market needed nearly 4 million properties to meet the country’s demand. That’s the equivalent of all the housing units in the state of New Jersey (plus 158,188 more properties) or almost 35% of the total amount of housing units in the state of Texas.

However, this is not a new problem. The housing market was experimenting with a supply shortage even before the Covid-19 pandemic. The thing is that it got pretty worse: if we compared this estimate with the one in 2018, it grew 52% percent in two years. And you know the drill: when the offer doesn’t fulfill the demand, the prices skyrocket. Real Estate IQ’s CEO Steve Liang warned about this on his last Hot Trends webinar. He pointed out, speaking about the Texas market, that while total sales were down in February, median home sales prices hit an all-time high, up 14% from a year ago to $302,920. This rise is more than double the median North Texas sales price a decade ago, and that’s something that happens every 20 years on average, not 10.

Freddy Mac considered that “a continued increase in a housing shortage is extremely unusual; typically in a recession, housing demand declines and supply rises, causing inventory to rise above the long-term trend.” Moreover, Freddie Mac’s chief economist Sam Khater explained: “This is what you get when you underbuild for 10 years. We should have almost four million more housing units if we had kept up with demand the last few years.” In dialogue with The Wall Street Journal, the expert clarified that the housing shortage is most prominent among entry-level homes, making it more expensive for first-time buyers to enter the market.

Why is the U.S. housing market 3.8 million homes short?

As you can imagine, there are several reasons involved in the housing shortage. Thus, blaming it all on the Covid-19 pandemic is a narrow approach to the topic. Of course, it didn’t contribute at all to the situation. As a matter of fact, in 2020, only 65,000 entry-level homes were completed, while there were 2.38 million first-time homebuyers that purchased homes.

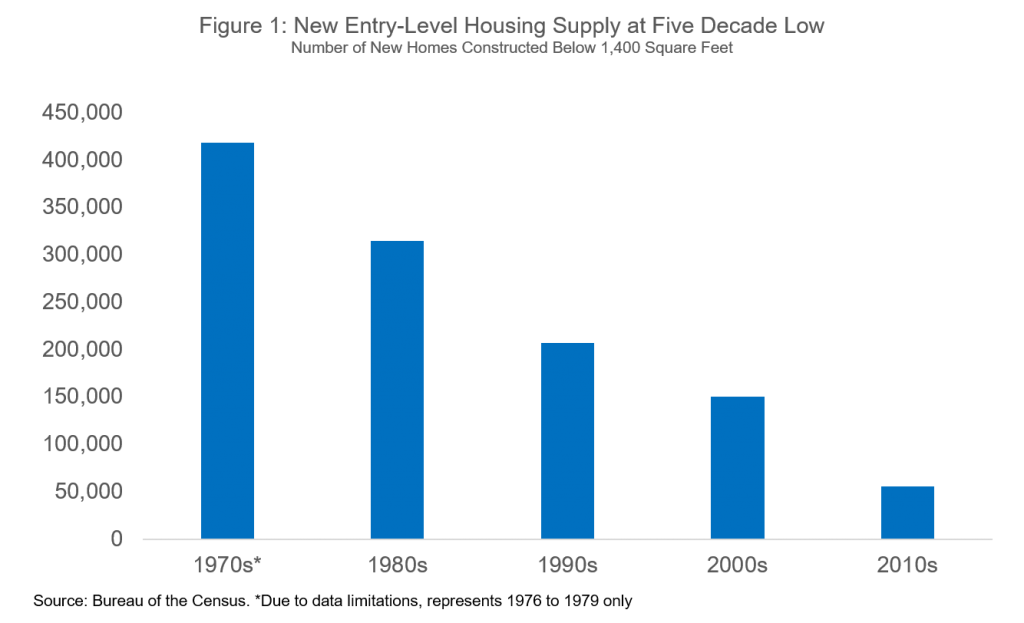

But Freddy Mac assures that the issue drives back to the late 1970s. For them, the main driver of the housing market shortfall has been the long-term decline in the construction of single-family homes. “In the late 1970s, the construction of new entry-level homes averaged 418,000 units per year. During the 1980s, mortgage rates increased dramatically, rising from an average of 8.9% to 12.7%. As a result, entry-level housing supply fell by more than 100,000 units to 314,000,” they wrote on the report.

By 1999, thanks to a decline in mortgage rates, the new single-family construction reached a 20-year high, though the entry-level supply continued to decline during that decade. The 2000s saw a substantial rise in new housing supply, but the entry-level properties didn’t reflect the increase. “Even at its cyclical peak during the 2000s, entry-level supply reached only 186,000 in 2004 – the same year that homeownership peaked”, the company assured. The fact that the homeownership rate peaked the same year as entry-level supply is indicative of the strong impact that entry-level supply has on homeownership. Very simply, renters can’t buy houses that don’t exist,” they explained. The 2010s wasn’t a good decade as well, and that leaves the market right where it is. To sum up, “in five decades, entry-level construction fell from 418,000 units per year in the late 1970s to 65,000 in 2020,” the company assured.

Sadly, the report doesn’t end on a higher note since it foresees that the problem will remain beyond the pandemic. “We expect the housing supply shortage to continue to be one of the largest obstacles to inclusive economic growth in the U.S. Simply put, we must build more single-family entry-level housing to address this shortage, which has strong implications for the wealth, health, and stability of American communities,” they concluded.

Disclaimer: The blog articles are intended for educational and informational purposes only. Nothing in the content is designed to be legal or financial advice.

Sources:

- http://www.freddiemac.com/perspectives/sam_khater/20210415_single_family_shortage.page

- https://www.businessinsider.com/us-housing-shortage-nearly-4-million-homes-fannie-mac-data-2021-4

- https://magazine.realtor/daily-news/2021/04/16/the-us-is-38-million-homes-short#:~:text=The%20U.S.%20housing%20market%20needs,the%20housing%20shortage%20since%202018.

- https://www.wsj.com/articles/u-s-housing-market-is-nearly-4-million-homes-short-of-buyer-demand-11618484400

- https://www.census.gov/quickfacts/geo/chart/NJ,TX,US/HSG010219