Troubled by mountains of debt, top Chinese real estate agents have teetered on the brink, leading to widespread property turmoil. This article delves into China’s current real estate crisis and extracts insights for the US market.

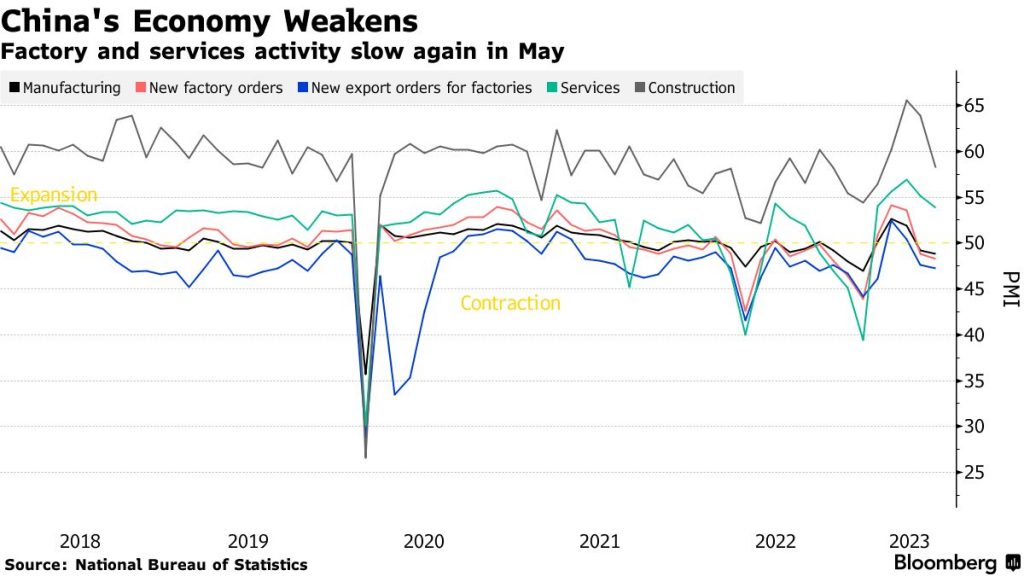

After years of real estate-sustained growth, China’s economic powerhouse now is slamming on the brakes. The NewYork Times summarizes this “real estate hangover” with a few key takeaways, where we highlight them here.

WHAT HAPPENED TO THE CHINESE REAL ESTATE INDUSTRY?

China’s property party ran wild for years. It, a job creator and middle-class wealth magnet, has been booming for decades and fueling this nation’s growth. At the same time, land deals are the lifeblood of many Chinese local budgets.

But the tide has turned. Chinese real estate businesses are currently struggling under a mountainous debt burden, compounded by a housing supply far exceeding purchasing demand. Unluckily, this crisis erupts as Beijing attempts to pivot its economy away from heavy dependence on state investment and exports and toward a more consumption-driven model.

Data from both the General Statistics Office of China and real estate brokerage firm Centaline Property paints a bleak picture of China’s housing market. Reportedly, newly built home sales in the country in 2023 decreased by 6%, returning to a level not seen since 2016. Transferred house prices in the four major cities of Beijing, Shanghai, Guangzhou, and Shenzhen plunged by 11-14% in December last year compared to the same period in 2022.

According to S&P Global Ratings, once soaring Chinese real estate giants are now bogged down in protracted talks with foreign investors, spooked by a massive $125 billion defaults on overseas bonds between 2020 and 2023.

Wall Street Journal reveals a trend of unconventional marketing strategies employed by Chinese developers and local governments to attract buyers. But these bizarre tactics were falling flat, and being seen as ineffective, highlighting the difficulty of navigating a changing market.

The picture gets direr and direr. China’s housing market suffers a widespread slump, with prime neighborhoods in major cities like Shanghai and Shenzhen experiencing at least 15% dips in existing home prices. Cities like Hangzhou, near Alibaba’s headquarters, haven’t fared better, witnessing a staggering 25% drop from peak prices.

Yet, experts believe China’s official housing price indexes are downplaying the crisis due to outdated methods that miss market downturns.

It is also crucial to note the real estate sector and related industries once contributed about 25% of China’s gross domestic product (GDP), and the sector downturn is leaving the world’s second-largest economy on shaky ground. A $390 million debt bomb, from Gavekal Research estimate, will loom large over the country’s financial system, and eventually put its 5% growth target at risk.

Country Garden, one of the world’s most highly indebted real estate developers, failed to make a $15.4 million USD bond interest payment within the grace period. Despite going mute since then, it did inform Bloomberg of potential difficulties fulfilling all future international debt obligations on time.

Facing its two-year-old debt default, China Evergrande Group – another China property giant – now confronts the risk of liquidation and disbandment due to the lack of a viable restructuring plan.

“VIRUS” DOES NOT STOP SPREADING

Sheng Song Cheng, former director of the Central Bank of China’s statistics department, delivered a grim outlook for the nation’s real estate market. He expects a two-year downturn and new home sales nosediving over 5% annually in 2024 and 2025.

The crisis “virus” is also impacting China’s trust companies – businesses that offer investment products with higher returns than traditional savings account and often invest heavily in real estate projects.

There is also a ringing alarm bell for how long this real estate “virus” will last. Nobody is buying, nobody can afford it, and nobody wants it, says ANZ’s Chief China Economist, Raymond Yeung. He observed a shift in Chinese attitudes towards property. Housing, once a coveted investment, has lost its allure, with low demand due to affordability and waning faith in its safety.

Many experts and firms urge Beijing to revive the struggling real estate sector. However, Chinese authorities have so far only implemented minor or transient policies such as tax breaks and eased lending restrictions, falling short of the large stimulus package many economists advocate for.

For China’s housing market to touch bottom, Liu Yuan, head of property research at Centaline, believed prices need to fall another 50%, reaching a point where buying makes more financial sense than renting. Government intervention is more important than ever to stop this drastic drop.

Over 50 private developers, drowning in debt, leave millions of homes in limbo. Beijing used to throw billions at the problem, but the unfinished apartment mountain keeps growing.

HOW THE CRISIS TROUBLED THE GLOBAL ZONE?

Research by BCA Research reveals China’s dominant role in global economic growth over the past decade, contributing more than 40%, compared to the US’s 22% and the Eurozone’s 9%.

Tightened consumer spending in China casts a shadow on the performance of foreign companies, impacting American technology players as well as European luxury brands.

So far, global investors haven’t reacted much to China’s economic woes. The S&P 500 has dipped for three consecutive weeks, but its year-to-date performance remains positive, driven by the uptrend of large-cap technology stocks. Meanwhile, investors in the US and Europe are more focused on what their central banks will do next with interest rates.

TRIED TO FILL THE CRACKS

The government has made efforts to clear out the foggy cloud. But it can be said that most of the spending and investment initiatives feel tepid, offering a lack of details and limited scope.

In 2020, Beijing used to tighten controls on real estate borrowing, aiming to curb debt and target companies like Evergrande and Country Garden that are already burdened with loans. This regulation squeezed real estate firms with heavy mortgage, driving over 50 in China to default on debt payments in the past three years.

Many unclear spending pledges and a partial rate cut disappoint economists and real estate investors who crave bolder steps. For example, The Central Bank of China (PBOC) lowered the 1-year basic interest rate for corporate loans but kept the 5-year LPR (used for mortgages) unchanged.

A series of the band aids at ailing real estate such as loosening credit for home purchases, lowering interest rates and down payment requirements, and fastening construction progress seem to only raise more concerns about long-term viability of the Chinese market.

LOOKING BACK AT THE “THREE RED LINES” POLICY

In 2020, China saw fit to reign in its roaring real estate sector with the “Three Red Lines” policy. However, this supposed safety measure sparked a crisis – the worst the country had ever seen. Since late 2022, China’s corrective measures have not fully mended the cracks.

The “Three Red Lines” policy mandated for real estate development businesses includes:

- Total liabilities cannot exceed 70% of total assets (excluding advances from projects sold under contract).

- Net debt must be lower than or equal to equity.

- Cash reserves cannot be lower than short-term debt.

Large developers face a multi-tiered debt assessment with color-coded results. Meeting all three criteria (green) grants them a generous 15% borrowing allowance next year. One, two, or three violations (orange, yellow, and red) tighten the limits to 10%, 5%, and a complete freeze (0%) on new debt, respectively.

As the industry-wide debt-to-asset ratio hovered around 80% in both 2019 (80.4%) and 2020 (80.7%), it became worse when many large enterprises overshoot the safe limit of 70%, including Evergrande – the former real estate global leader in 2018 and now the most indebted firm in China.

As of 2019, Chinese real estate developers’ meager equity (6.6%) barely covered their massive debt burden. Excluding cash, their total debt stands at 3.98 times their equity, and short-term loans alone consume 1.64 times their available cash.

The “Three Red Lines” abruptly cut off the traditional lifeline of Chinese real estate companies: using new debt to cover old. This choked off growth, culminating in Evergrande’s August 2021 default and triggering a domino effect. Today, major players like Shimao and Sunac remain in limbo, while analysts foresee a bleak future for almost two-fifths of the industry.

In December 2022, China introduced new policies signaling an implicit departure from the “Three Red Lines”. At its core, a 460 billion USD credit injection from state banks revived domestic lending. Additionally, access to international capital has re-opened, prompting cautious optimism among real estate developers.

But the real estate crisis remains unresolved, as the IMF cautiously admitted. An analysis of their article IV advice underscores this, highlighting the need for further regulatory restructuring to clear out the root cause of the turmoil.

INSIGHTS FOR US POLICYMAKERS

Untamed markets can easily stumble, even giants like the US real estate sector. The US housing downturn may seem to have cooled off, but it’s not immune to unseating. To stay ahead of the curve, real estate players need to constantly grow and adapt.

To build a resilient market, it is important for the US property market to focus on these key policies: First, have a clear understanding of market rules and stick to the implementation of policies that encouraging compliance with market regulations to prevent or mitigate future errors. In addition, transparency in information systems and processes is paramount in the current slump context.

Second, to foster a vibrant business environment, a level playing field encouraging fair competition should be executed.

Third, implementing market interventions requires careful calibration and drawing on international experience to prevent overstimulation, especially concerning vital financial flows.

Fourth, sustainability and political pragmatism should guide sector selection. The administration needs to encourage robust growth in areas unlikely to trigger political firestorms.

While the Chinese example illustrates the potential dangers of excess, America’s own challenges since 2008 offer a lesson in the pitfalls of a self-focused agenda. It may be apparent to see that a critical self-assessment is imperative for the US to break free from the pattern of self-serving policies and excessive risk-taking.

Reece Almond

Disclaimer: The blog articles are intended for educational and informational purposes only. Nothing in the content is designed to be legal or financial advice.