Renter’s worries have been happening for a while, we know. Housing costs are topping up, homeownership is far out of reach, for-sale inventories touch the bottom-line and climate risks are snarling the stock, we all know.

Housing costs are squeezing wallets nationwide, according to a recent report from Harvard University’s Joint Center for Housing Studies. The study, which is based on their existing data, found that nearly a quarter of homeowners are feeling the pinch – the housing costs are stretching their budgets thin. And worse, renters got it even tougher.

“Everybody feels they’re being squeezed by the cost of living, even affluent people,” said Zev Yaroslavsky, director of the Los Angeles Initiative at the Luskin School, said to LA Times. But for renters, that pressure is especially acute, he added.

The reason why renters struggle so much: housing costs are rising, and it’s rising faster than the leaves turn brown.

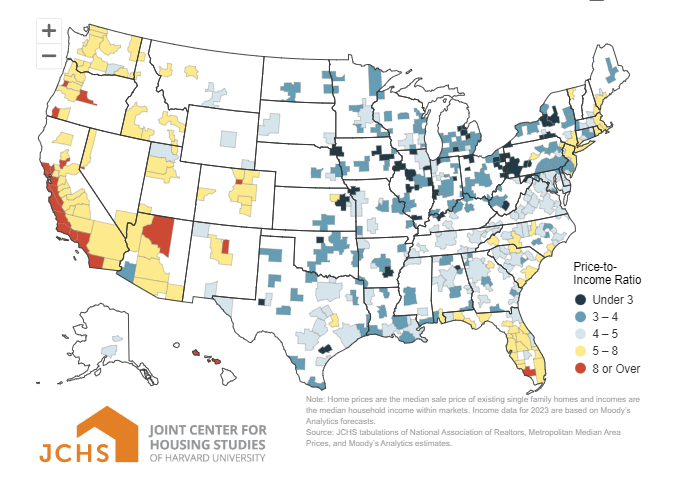

Harvard researchers saw a bitter soar of 47 percent higher in US home prices index this year compared to early 2020’s. This creates a huge gap between median house prices and median household income, with housing costs rising 5 times faster than incomes. Such a high cost of living, particularly housing, is dumbing down quality of life for many Americans across the states, especially renters who bear the brunt of overwhelming cost burden rates.

“Housing costs are a particular pain point for American households,” Lael Brainard, director of the White House’s National Economic Council, said at an event in Washington, reported by Yahoo Finance.

To picture the renters’ financial strain more clearly, rents have been climbing non-stop since the post-pandemic era. According to Rent.com, rents surged 0.8% in May compared to last year, nearing the record high set in August 2022.

But it’s not all doom and gloom. Rents in traditionally affordable Midwestern cities like Cincinnati are skyrocketing (up 10.9%), while fast-growing Sun Belt metros like Jacksonville are seeing some relief with rents dropping by 10.1%.

As we mentioned, when rents are increasing, incomes have not been keeping pace. Harvard housing analysts reported that people making over $75,000 a year saw their income grow 3% since 2001. However, for those in the middle- and lower-income brackets who rent, it’s a different story. Their buying power has actually shrunk.

Those making $30,000 to $75,000 a year saw a 2% drop in their income, and for renters making less than $30,000, it’s even worse – a whopping 12% drop. And things got even tougher for low-income renters during the pandemic, with job losses and lower wages due to shutdowns.

“Will this ever end? Will it ever get better? Can I get out of this?” said Alex Larraza, 29, who said he pays 49 percent of his $55,000 annual salary toward rent and utilities for a duplex in North Kingstown, R.I.

You can’t stop the market, but you can try to control the controllables. As a renter, here are a few options from Rent.com that you can move on to minimize the risks.

If your rent prices are rising, the first thing is talk to your landlord. See if you can negotiate a longer lease for a discount, reminding them you’re a reliable tenant. Plus, try to do research for similar apartments to see if your rent is fair, or consider sharing an apartment with roommates to split the cost. Furthermore, you can look for assistance programs and local housing support services available. Budgeting and applying for help can make a real difference.

If your rent prices are dropping, use that leverage! Don’t be shy to ask for certain perks like free parking or covered maintenance. Also, take note that your housing needs may change over time. Maybe a smaller, trendier house located in a more upgraded neighborhood is what you lean towards to, and this could be the push you need to start saving for a down payment on that dream house.

Disclaimer: The blog articles are intended for educational and informational purposes only. Nothing in the content is designed to be legal or financial advice.

Reece Almond