The National Association of Realtors’ recent shake-up has a clear implication: the home buying and selling process may undergo significant changes, and the current commission system is about to change. This raises questions about what is the average real estate commission rate so far?

A rundown: how the real estate commission model will be structured from August 17

When selling a home, you’ll likely sign a listing agreement with a realtor. This agreement involves a commission fee paid by the seller after the sale closes. Of course, there are different types of listing agreements, but with an “exclusive right to sell” agreement, you’ll owe the commission even if you find the buyer yourself.

Traditionally, both the buyer’s and seller’s agents are paid by the seller from the home’s sale proceeds. This total commission is then split in half between the two agents: 3% for the seller’s agent and 3% for the buyer’s agent.

This means, before, buyer’s agents knew their commission upfront. Now, with new rules, they can’t advertise set fees. Though commissions were technically negotiable, agents’ expertise kept them around 5%. A new settlement changes the game. Buyer agents can now advertise fees openly, sparking competition that could slash rates. Stephen Brobeck, Consumer Federation of America’s senior fellow, predicts dips below 4%, maybe even 3%.

So, what’s the average real estate commission rate by states?

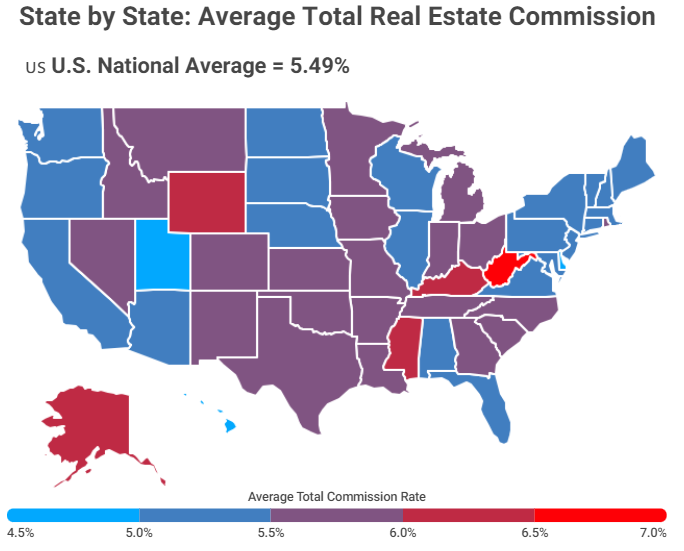

New research by Clever reveals a national average real estate commission rate of 5.49%, typically split between buyer’s and seller’s agents. But these rates are not for all states, most of states’ rates vary between 5% and 6%.

But why do real estate commission rates differ so much?

Clever also breaks down the scoop on why commission rates can vary so much across the country.

The biggest reason for that is how much the house itself costs, or we call how much the home value costs.

In places like California or New York, where homes are always breaking the bank, commission rates are often lower as a percentage. Even at a smaller cut, agents end up making a good amount because the total sale price is normally very high.

On the other hand, areas with lower property values, like Ohio, might have higher real estate commission rates. This makes sure agents still get a decent amount of money even though the overall sale price is lower.

The difference also depends on each state’s legal frameworks.

Let’s say: Washington has strict rules requiring upfront communication of commission rates and other fees in a signed agreement with both buyer and seller before any services begin. Or Texas is likely to prioritize general transparency, expecting realtors to be clear about their fees but without dictating the exact timing or format for disclosure.

And not all states allow realtors to represent both the buyer and seller (dual agency), which is another factor building up the difference of commission rates among states.

Certain areas, such as Colorado and Oklahoma, have banned it altogether to avoid potential conflicts of interest where the realtor might favor one side over the other.

However, in states where dual agency is allowed, it could mean lower commission costs since one agent is doing double duty. But still, there can be complications with this approach.

Stats on public opinion of NAR real estate commission change

Clever took the pulse of the housing market with a double dose of surveys. Reportedly, Clever polled 1,000 Americans looking to buy or sell, and tapped into the expertise of 331 real estate agents (mainly handling both buyers and sellers). Here’s how they react:

- 67% of Americans support real estate commission changes, but 70% agents push back.

- Over 6 in 10 Americans (61%) agree with the core argument behind the NAR lawsuit: sellers shouldn’t be responsible for the buyer’s agent commission.

- 82% of real estate agents (82%) predict real estate commission changes will harm home buyers.

- 66% of first-time homebuyers indicated that they can’t afford agent commission on top of other costs.

- More than 56% of real estate agents predict properties will sit longer after the NAR lawsuit settlement finally comes into effect.

- 95% of agents surveyed think a new real estate commission structure will eventually drive them out of the market.

Reece Almond