Supposed to be a heated phase of the year with shoppers and sellers come in and out always, but this summer seems like a housing market full of thorns, or more likely “a very strange market, and it’s kind of hard to predict”, said Jeff Ostrowski, a housing analyst at Bankrate.

Summer housing market: what usually happens, what to expect?

We are gradually moving past the limp spring home-buying season, where non-stop high home prices and rocketing mortgage rates keep unmotivated shoppers out of the loop, into a summer housing market with lots of expectation.

Most homebuyers hold out hope for a price relief this summer, but it seems unlikely. According to Mark Fleming, chief economist at First American Financial Corporation, the slight recession in home prices in certain markets and a noticeable rise in inventory do not guarantee affordability will see a jump, at least in the next three months.

“A ‘higher-for-longer’ mortgage rate environment will continue to sap house-buying power,” Flemming, chief economist at First American Financial Corporation stated.

So, what should a hectic summer housing market look like? As obvious as it can be more home sales, fast closings, inventory level spikes up and so do home prices.

Why is summer the golden season for buyers, sellers and investors? We prefer saying it has a lot to do with the season itself.

With warmer weather and longer daylight hours, there is more flexibility to pack and get settled before the new school year starts, especially for families with kids. This surge of demand creates a competitive housing market, with properties selling quickly and potentially sparking bidding showdowns.

Besides, because fall and winter (from Halloween through New Year’s) exude holiday chaos, summer, along with spring, is the sweetest spot to dive into the housing market. Sellers wouldn’t want their homes constantly show-ready, and buyers wouldn’t want to be house hunting amidst the gift-wrapping frenzy either.

Normally, summer is that ideal escape for motivated sellers, serious buyers and active investors before things start to slow down again.

Now looking into the latest housing market’s updates, there are quite a few snapshots you should be aware of to pull your acts together this summer.

Inventory is on the rise compared to last year (good sign!), but it’s still a far cry from the pre-pandemic days’ level.

The Midwest and Northeast have seen less competition for sellers due to lower inventory levels, leading to stronger price growth compared to last year. In contrast, the South and West are experiencing a rise in new listings, which is helping to cool down price increases. Cities like Austin (+33.6%), San Antonio (+31.8%), and Denver (+22.0%) also boast inventory levels exceeding pre-pandemic times.

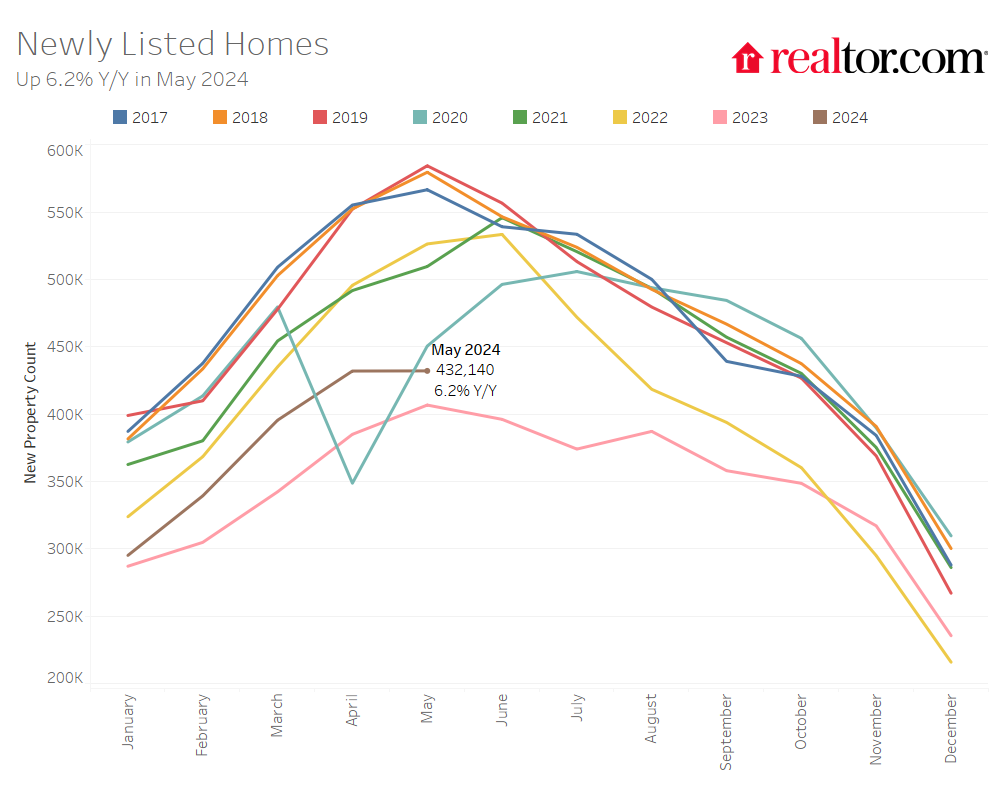

Realtor researchers reported that newly listed homes jumped 6.2% in May compared to last year. While that’s a slowdown from the sizzling 12.2% growth we saw in April, it’s still the seventh month in a row of increasing listings after a long dry spell. Plus, the number of homes actively for sale also increased 35.2% year-over-year in May.

Explaining the rise in new listings we are seeing, it can be said that many homeowners have life changes prompting a move – multi-family needing more space, empty nesters wanting to downsize, or job relocations. But a dilemma arrives when their usual rock-bottom mortgage rates (around 3%) make it tough to justify a new loan with current rates skyrocketing to 7%. Still, the housing market waits for no one, and some are taking the leap, that’s why this “want-to-sell” group is likely fueling the inventory activity.

Home prices may not be budging, but capital gains taxes are taking a bigger bite, and home sellers are being pushed into a corner.

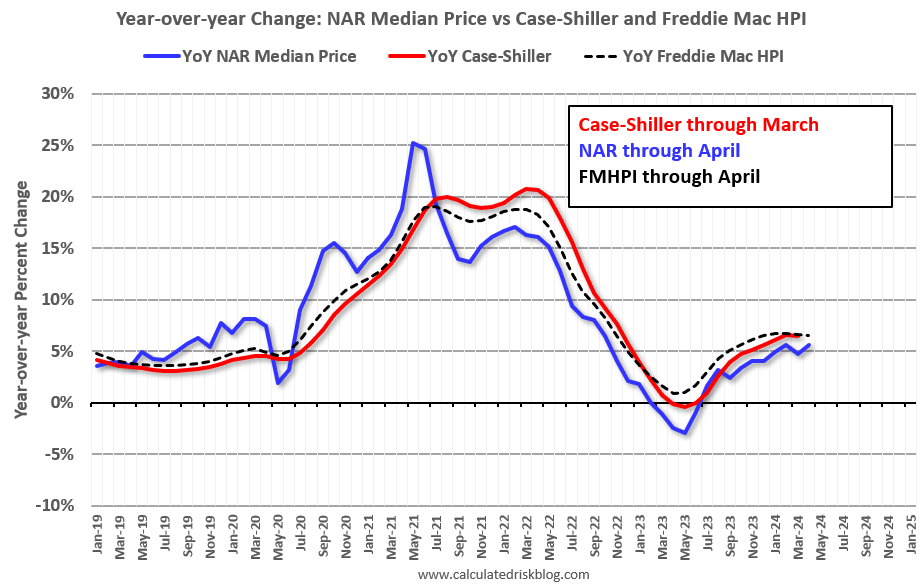

Home prices still inch up across the country, but sluggishly and slowly. Take note that the feeding frenzy for houses is now a thing of the past. As buyer options multiply and NAR settlement starts taking effect this July, sellers face a choice: adjust their pricing or wait for a serious offer. Inventory’s rise may mean the housing market is getting closer towards normalcy. Yet, the scenario of lower rates is less likely to happen, leaving sellers with a shrinking advantage.

Historically, home prices are down 2.2% (adjusted for seasonality) from their peak and unlikely to rebound soon. Keeping a close eye on the housing market’s index (inventory, mortgage rates) and adjusting our forecast accordingly are the best things we can do, at least for now.

One more thing to take note: a proposal from the Biden administration for an increase to 44.6% capital gains rate is introduced, which can make a significant impact on the housing market. A study from CoreLogic found that 7.9% of US home sales in 2023 exceeded $500,000 in capital gains, potentially triggering taxes and causing some home sellers to hold onto their properties, fearing a big chunk of their profits will go to the IRS. “The result is, fewer people putting their homes on the real estate market can create housing shortages and housing affordability issues.”, Jimmy Panetta, a Democrat from California, said to Realtor.com.

Not surprising: mortgage rates continue to hit the ceiling

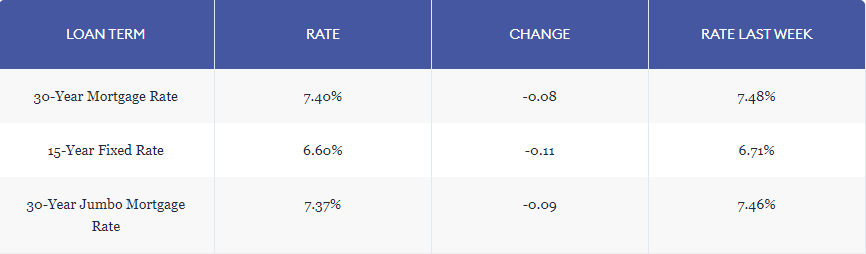

Well, there’s some good news for those looking to buy a home: 30-year fixed mortgage rates dipped slightly this week fell from 7.48% to 7.40%. At the same time, rates for 15-year fixed mortgages are down to 6.60%, making it a decent time for borrowers who want to pay off their home faster, according to Forbes. But refinancing may come with costs, so be sure to compare your current rate to today’s housing market rates to see if it makes financial sense.

This summer witnesses a picking-up-steam housing market, but this is steam from hell, especially for home sellers, said James Rodriguez, senior real estate reporter on Business Insider’s Discourse team.

Don’t panic, here’s your exit strategy this summer housing market

“High mortgage rates, high home prices, low inventory stock, all happening at once, so the market feels a little bit unaffordable”, stated by Stephanie Berkin, president of R New York, one of NYC’s largest real estate brokerage companies, on NBC News last Monday. And here she gives us a look at scalable strategies, whether you are sellers, buyers, investors or renters, to navigate through this summer housing market.

Buyers are all looking for the same properties, so we should work in their favors. Pricing is so important; you can price it at or slightly below, so people perceive a deal. Because so many people are pushed out of the market, now is the time to buy. Buy smart and buy now, and refinance later. Because the rates are going to fluctuate, and when they drop even by just one point, everybody else is going to rush into the market, and prices are going to rebound.

For buyers, it’s about understanding your budget, which sounds so simple and obvious. A lot of people throw out percentages, but it’s better to think about a concrete number, and how that translates into your affordability. Remember, everything, not just the costs, from pull-in costs, commissions which are just starting to change to down payment. Be flexible with location, focus on your priority. And you must work with a knowledgeable agent, someone who can guide you and advise you as there are many things changing in the industry, and you need someone to educate and protect you in real time. Regarding the mortgage rates, shop around. Because rates and fees vary, make sure to take advantage of the dynamic season, then choose the best rates for you.

For sellers, the most detrimental thing a seller does is overprice your property. You need to price it right, at or below market, presenting a move-in property, together with a clear and ideal staging, and your property will be as effective as it should be. Make sure your home is turnkey, and as a seller, you can fix all the issues. Even when you’re thinking of selling six months from now, capture all the marketing materials now so you can show your property in the off-season or post-season even when you’re not coming to the market till fall or winter.

Reece Almond

Disclaimer: The blog articles are intended for educational and informational purposes only. Nothing in the content is designed to be legal or financial advice.