It’s less likely, than ever, a seller’s market, where existing home sales keep dropping, median house prices go on soaring, and mortgage rates are leaving housing market watchers far short of their expectations.

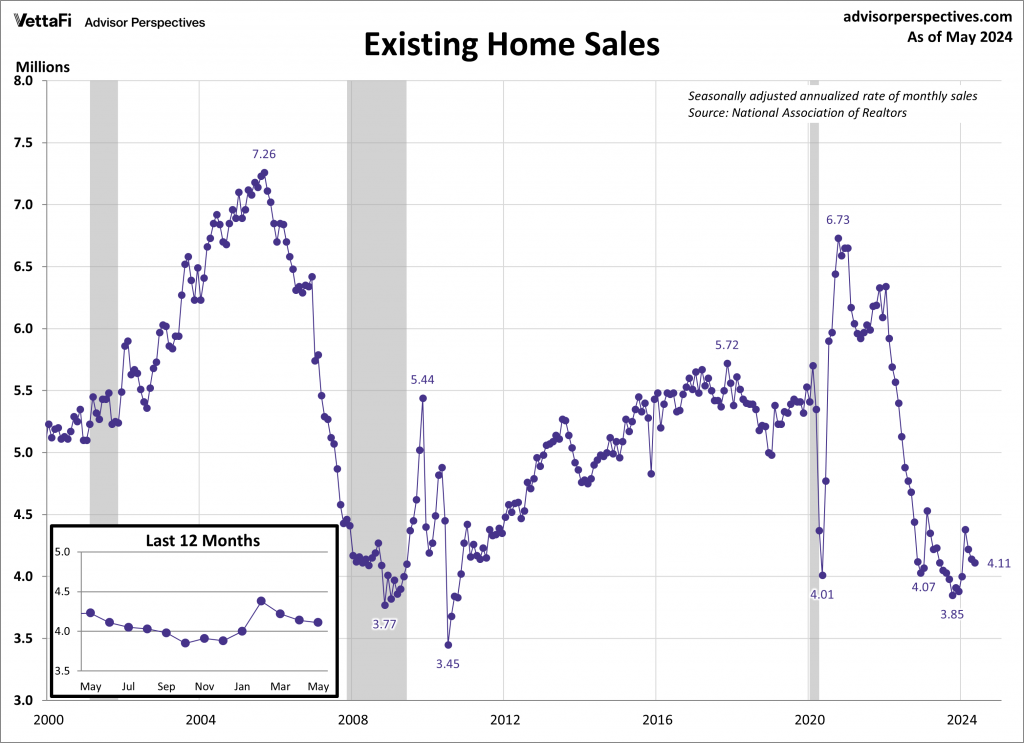

Fact check: Home sales dipped again

According to National Association of Realtors (NAR), the housing market continued to cool in May, with existing home sales dipping and prices on the rise. Sales of existing homes, including the count of single-family houses, condos, townhomes, and co-ops, fell slightly, down 0.7% from April and 2.8% compared to May 2023. This decline occurred despite an increase in available listings.

We can say that homebuying got trickier. Affordability has gotten worse that many people are throwing in the towel, both buyers and sellers. People who were thinking of selling their homes to move up are now stuck, because trading in their super-low 3% mortgage for the new rates around 7% just doesn’t make sense.

“I don’t know if I am typical, but I will not sell my house. My mortgage is paid off, and the rental income is substantial. My Gen Z kids will inherit the house and can choose to sell it or keep renting it out for passive income. In my area, construction costs are very high, so there are no new homes.”, a Baby Boomer caught in a housing market bid.

And talking about home sales means talking about home prices. For the 11th month in a row of year-over-year price increases, the median sale price for existing homes in May hit a staggering $419,300 nationwide, jumping 5.8% from last year, and the highest price ever recorded by the National Association of Realtors, reported by Jeff Ostrowski, principal writer of Bankrate.

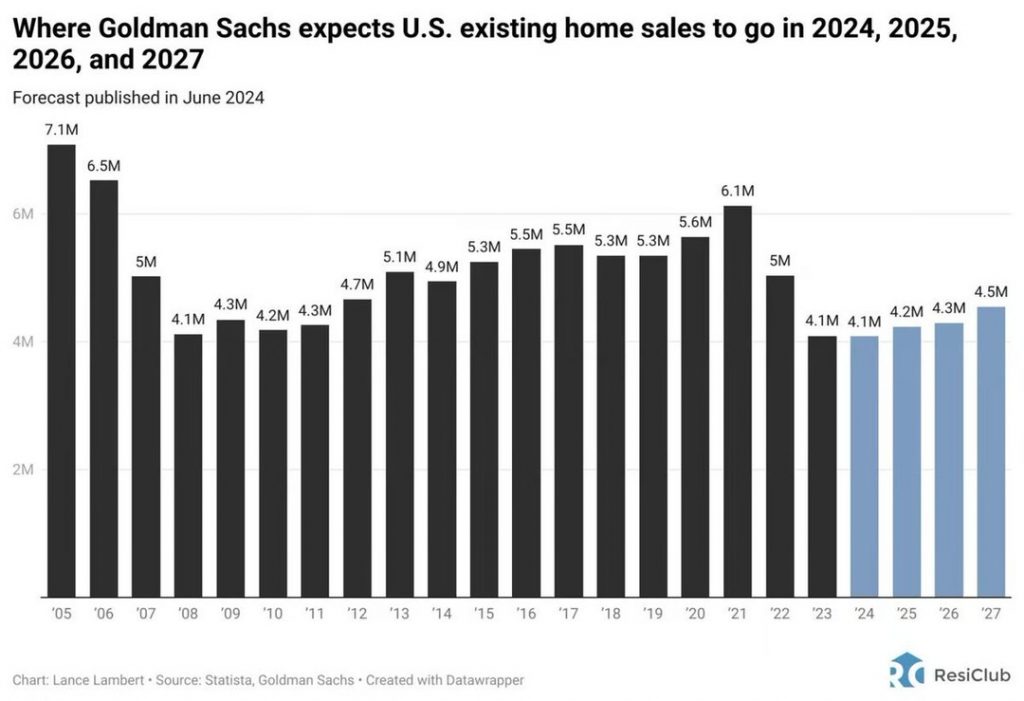

What’s more, housing demand was expected to “remain firm”, according to Goldman Sach in early June. This sweet spot should keep the homeowner vacancy rate around 1.1% by the end of 2025 – that’s a smidge higher than the 1.4% in 2019, but still low. With the housing market calming down a bit, it is forecasted that national home prices to rise at a steady clip of 3.8% by year-end. No more crazy bidding wars, but things should still be “enough” for sellers to move on.

These indexes are a strong indicator of what the housing market might look like in the next 3 years, especially in terms of the home sales volume.

Also from the report, Goldman analysts potentially see a slight drop in mortgage rates: average 30-year fixed mortgage rate will likely shrink to 6.5% by the end of 2024 and to 6.3% by the end of 2025.

Obviously, these mortgage rates won’t dip big anytime soon. But once it does, “home prices could surge by 20%!”, Barbara Corcoran, known as the Queen of New York Real Estate, predicted in a recent Fox Business interview.

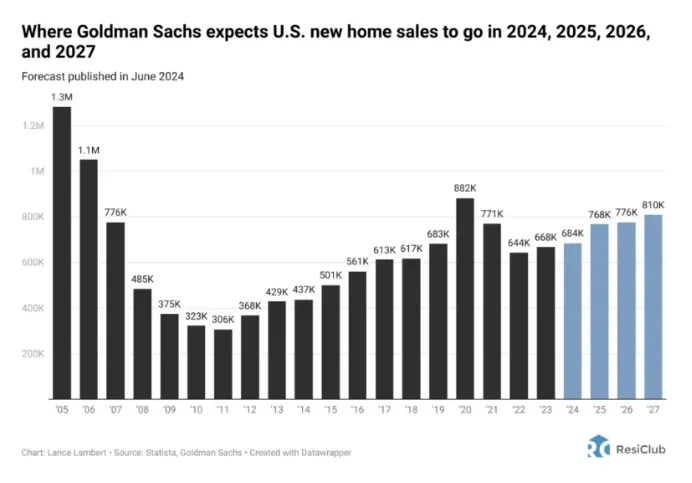

All this sheds a key insight on the new home market: the market for new homes is performing better than the market for existing homes.

Basically, builders of single-family homes have a bit more freedom. They’re not affected by the “lock-in effect,” so they can keep developing and building new houses. In fact, sales of these new homes have been climbing up, even reaching levels close to what we saw back in 2007.

In certain areas, some are dropping prices or helping with mortgage rates to move inventory. They’re even building smaller, more affordable homes while some existing home sellers are holding firm on prices or refusing to drop low.

Now take a quick look at these top 10 hottest sellers’ markets where over 60% of the home sales were new homes, reported by Zoocasa, one of the most updated real estate listings agents, so you can make the most out of gains before this summer slips away:

- Indianapolis: 82% (Sales-to-new-listings ratio is over 82%)

- Baltimore: 82%

- Phoenix: 78%

- Columbus, Ohio: 75%

- Tampa, Florida: 74%

- San Diego: 72%

- Tucson, Arizona: 72%

- Richmond, Virginia: 72%

- Albuquerque, New Mexico: 72%

- San Jose, California: 70%

The most important note for our readers, especially for first-time homebuyers, is to soak in perks that off-market leads offer, stated by Real Estate IQ’s CEO Jon Huang:

“Leveraging off-market leads provides a significant advantage for real estate investors, offering access to hidden opportunities with reduced competition and potentially better deals. Off-market properties [1], [2] are not listed on the Multiple Listing Service (MLS), allowing investors to negotiate directly with sellers for more flexible terms and lower prices. This can result in smoother transactions and higher profits.

One effective strategy is mortgage arbitrage [3], [4], [5], which involves exploiting differences in mortgage rates and terms to benefit both buyers and sellers. In a high mortgage rate environment, this method can offer a creative solution. For example, sellers can offer financing options at lower rates than current market rates, making the property more attractive to buyers who would otherwise face prohibitive borrowing costs. This not only helps sellers achieve better sales prices but also provides buyers with more affordable financing options.

Real estate investors can maximize these opportunities by combining various strategies, such as direct mail marketing, networking, and engaging with real estate agents and wholesalers. These methods help build a pipeline of off-market leads, ensuring a steady flow of potential deals.

In conclusion, leveraging off-market leads and mortgage arbitrage [6], [7] can provide substantial benefits in the current real estate market, offering competitive edges in securing profitable deals while managing the challenges posed by high mortgage rates.”

Disclaimer: The blog articles are intended for educational and informational purposes only. Nothing in the content is designed to be legal or financial advice.