ESG criteria has been a standard for years, but Net Zero, as industry giants in real estate investment and management, including CBRE, Cushman & Wakefield, and Transwestern believe, is the new frontier.

What is it?

Many may have already got the right guess out of the word itself. The idea of a zero-emissions building is simple – a building that doesn’t pollute at all. But the official explanation for it is still less than clear.

“There has been quite a lot of confusion in the market around the transition to zero-emissions buildings,” states Heather T. Clark, director of building emissions at the White House’s Climate Policy Office. “Many people were using terms like net zero, zero carbon, and other terms in a way that was very inconsistent and confusing.”

In fact, there are quite a few definitions for this.

At World Green Building Council (WorldGBC), a building can be called net zero if its energy consumption is completely offset by on-site renewable energy generation.

The Biden-Harris administration also brought a draft definition of net zero to the table. It, which “serve as a very clear market signal to help transition the building sector”, has three main pillars: Buildings should be highly efficient, free of on-site emissions from energy use and powered solely by clean energy.

According to Clark, a fancy building that guzzle energy are not helpful if they are just inhaling power from dirty plants. A house with zero emissions itself is not enough if its electricity comes from a faraway coal burner. The key to a greener building industry, as the definition clarifies, is hitting all those three aspects.

CAN BUILDINGS BREATH EASIER WITH “NET ZERO”?

40% of CO2 emissions comes from the real estate sector, which says a lot about how difficult it is for the industry to immediately shift lane to a low-carbon transition. Buildings are a major climate culprit, with 70% of emissions coming from daily use and the rest from construction.

That being said, buildings are required to cut back on pollution – both how they run and how they’re built in the first place. The real estate industry needs a big shift to make this happen, and net zero is the way to go.

Why? Orbis shed light on two main incentives.

First, going net zero will be the best risk management strategy for the property segment.

Climate change throws a nasty mix of threats at buildings – from physical damage to skyrocketing insurance costs and higher operating expenses. With over a third of real estate investments already in climate danger zones, sustainable building practices are the clear solution.

A Bank of England study shows a worrying trend: high-emitting buildings lose value after climate policies hit. This reflects a shift in the real estate market, with both investors and homeowners prioritizing sustainable assets. It’s about saving money and aligning with climate-conscious values.

Second, the net zero strategy is the win-win situation across the board in real estate.

For shareholders, green buildings means green profits. Office space with top sustainability certifications can command rent premiums of at least 10% with lower vacancy rates, and even cut operating costs by up to 14%.

For talent, eco-conscious workplaces are “hot” property, and going green seems to be the best act of attracting top talent. A recent Harvard study even showed that certified green buildings boost cognitive function by 26%, leading to happier and more productive employees.

Especially for investors, net zero assets are not just the nicety. Indeed, they are the real deals. Any type of property that demonstrably champion a “green” transition – one that prioritizes both social and environmental well-being – will hold a good spot for raising capital.

Sustainability now is a market force factor that leads the trend. Increasingly, investors expect action on various environmental fronts. A recent ULI report underscores this point: nearly 70% of investors and all investment managers surveyed anticipate increased focus on social value and impact investing over the next two years.

Every building has a lifespan before needing upgrades. Sustainable ones may depreciate slower, offering a longer lifespan of peak value. Conversely, properties lacking sustainable features risk becoming obsolete faster.

At the same time, there has been proofs of REITS in the US suggests green-certified buildings are more stable during economic downturns, indicating lower exposure to market risks. This resilience could pave the way for widespread adoption of net zero buildings in the future. And don’t forget that net zero transition is spreading value to other sector of real estate. For exmaple, green financing.

Green financing, including green loan, bonds, is like good grades in school. Eco-friendly buildings can get them A’s from lenders. Most of the time, special loans are available based on how “green” the building is.

So yes, buildings can breathe a bit easier with net zero, with all the foreseen returns and less price volatily, but achieving it is not easy, of course, as we buy a caramel brownie. Gresb confirmed that “there is no consensus that we can achieve a zero embodied carbon built environment, and that most carbon accounting principles prevent an entity from reducing their overall footprint beyond zero”.

Undeniably, the process itself is risky. “We have to take the whole lifecycle of each building into account, from new build all the way through operation, refurbishment and in some cases to redevelopment. So, we are measuring and reducing the embodied carbon at the construction stage, which includes the materials used and the build process, and reducing energy demand in the operational phase.”, says Shuen Chan, Head of Responsible Investment & Sustainability at LGIM Real Assets.

It is a global goal for 20 years from now in order to limit dual climate and real estate is at the centre of all these decarbozing efforts.

SPREAD THE NET, SET THE TREND

The push for net zero buildings is gaining serious momentum, and there’s good reason to believe it.

Last year, the Net Zero Carbon Buildings Commitment is gaining traction with 175 signatories, including 140 business signatories managing nearly 20,000 buildings across 75 countries. This industry-wide push intended to tackle building emissions by nearly 40% globally by 2050, with substantial progress by 2030.

Dubai also unveiled the SEE Institute, the sustainability research, development and professional training, back in 2021, the world’s first carbon-balanced building, achieving net-zero status by offsetting emissions from material production.

Meanwhile, the UK’s Curzon Wharf tower in Birmingham is aiming to be the world’s first carbon-neutral high-rise solely for its operational emissions, excluding the embodied carbon from construction materials.

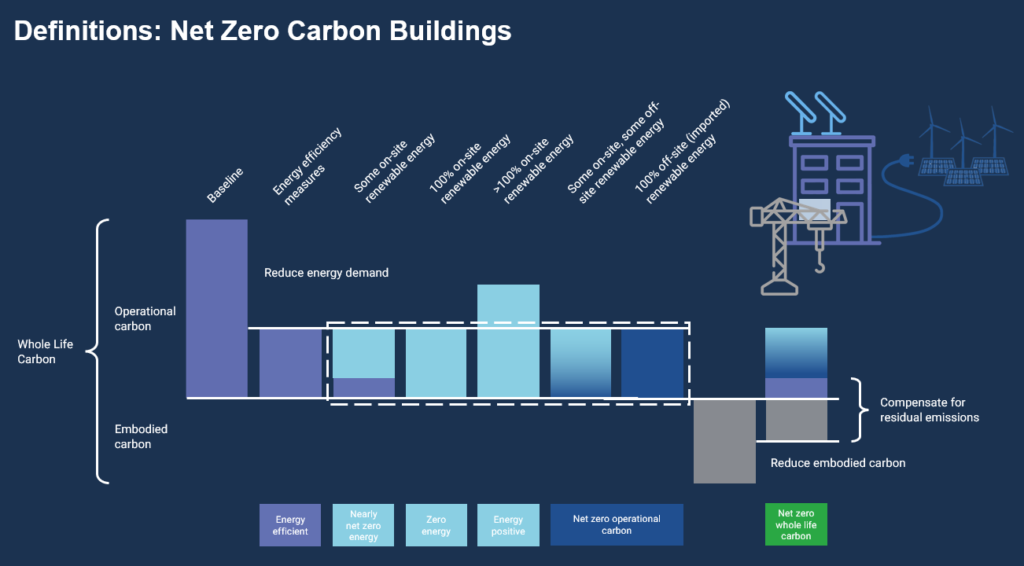

That’s the net zero carbon buildings. And they are different from a net zero energy construction, which will be called out now.

Basically, net zero carbon buildings are “highly energy efficient and fully powered from on-site and off-site renewable energy sources. This means, such buildings neither consume non-renewable energy nor produce greenhouse gases. Renewable energy resources like wind turbines, hydropower generators or solar panels provide energy to these buildings.”

On the other hand, net zero energy buildings “have zero net energy consumption. These buildings use non-renewable energy sources and produce greenhouse gases. In short, they offset the harm done by producing an equal amount of renewable energy or by buying carbon credits.”

Zero carbon buildings can be more stringent than zero energy buildings. Because the first type focus on energy use, and the later choose to go even further to tackle all their carbon footprint. While being energy-efficient is a great first step, achieving true eco-friendliness means thinking about all the carbon involved, not just energy.

Reportedly, there were only 500 commercial buildings achieving net zero energy status back in 2018, but only 3 years later, the number jumped to nearly 700, with a big increase in states that prioritize fighting climate change. Their total area has also grown by 38%, reaching 62 million square feet.

Still, anything catching on trend is criticized, one way or another. But in long term, net zero is the new standard that sets the foundation for good business sense. Here we can see that sustainability leaders agree it’s not just good for the environment, it’s good for business too.

“So many of our clients, especially the ones that are publicly traded, are hearing from their shareholders, just like we are, wanting to know what climate risk and opportunity means to their organization, and what are they planning to do about their carbon footprint?” said CBRE Vice President of Corporate Responsibility Jennifer Leitsch of the industry’s uptick in interest in net-zero carbon. An embrace of net-zero carbon can be one piece of the puzzle in luring employees back to an office, she added.

“Having a company that has a purpose, that is looking to do things that advance environmental and social initiatives, in addition to increasing the value of the organization, are the types of things that employees get excited about,” Leitsch said. “I really do think that companies who embrace environmental initiatives with things like net zero will see engagement from employees who really care about those things.”

“In many ways, the expectation is by 2030 net zero will be basically the new building code, even in many of the largest cities here in the United States,” Josh Richards, Transwestern sustainability director said, describing the trend as the next wave in differentiation in sustainability in commercial buildings in the next decade, the same way LEED certification was in previous decades. Sustainability-focused millennials and Generation Z members will help to drive net zero as a requirement in future decades as they mature in the workforce, Richards added.

Reece Almond

Disclaimer: The blog articles are intended for educational and informational purposes only. Nothing in the content is designed to be legal or financial advice.